Rapidio's Next-Gen Features

Hey there! Dive into our latest features and see what we’re crafting next. It’s all about making lending smarter, faster, and more adaptable for you. Come explore our innovations and stay ahead of the curve.

🚀 AI-Powered Document Classification & Extraction (11/22/2023)

Sort, label, and extract key data from any mortgage document — in seconds.

Rapidio’s proprietary AI/ML engine is trained on 650+ document types (and counting), delivering unmatched speed and accuracy.

Automatically identifies even complex or state-specific forms.

Let the system handle PDFs, scans, and images — even messy uploads.

From small teams to enterprise lenders, our model adapts to your volume.

🔗 Seamless Encompass Integration (03/27/2024)

Integrated with Encompass by ICE, Rapidio brings automated income tools directly into your existing workflow.

Calculate income without leaving Encompass.

Streamline loan processing and approvals.

One-click access to accurate, audit-ready results.

📄 All-New Final Report Experience (05/23/2024)

Everything you need — beautifully packaged. We’ve redesigned our final reports.

- Easily navigate income breakdowns, borrower details, and documentation — all in one place.

- Make every report look like it came straight from your team — perfect for brokers and enterprise clients.

Automatically generated and aligned with income type and guideline — ready for your underwriters to review or copy into DU/LP.

This feature is Deployed !

Smart Loan Conditions for All Guidelines (06/18/2024)

Built-in compliance. Tailored to every income type.

Always aligned with FHA, VA, Fannie Mae, Freddie Mac, Non-QM, and more.

Automatically generated & income-specific.

Conditions are grouped into Extremely Important, Important, and Standard, so underwriters can focus where it matters most.

Fully customizable. Overlay your internal underwriting logic to match how your team already works.

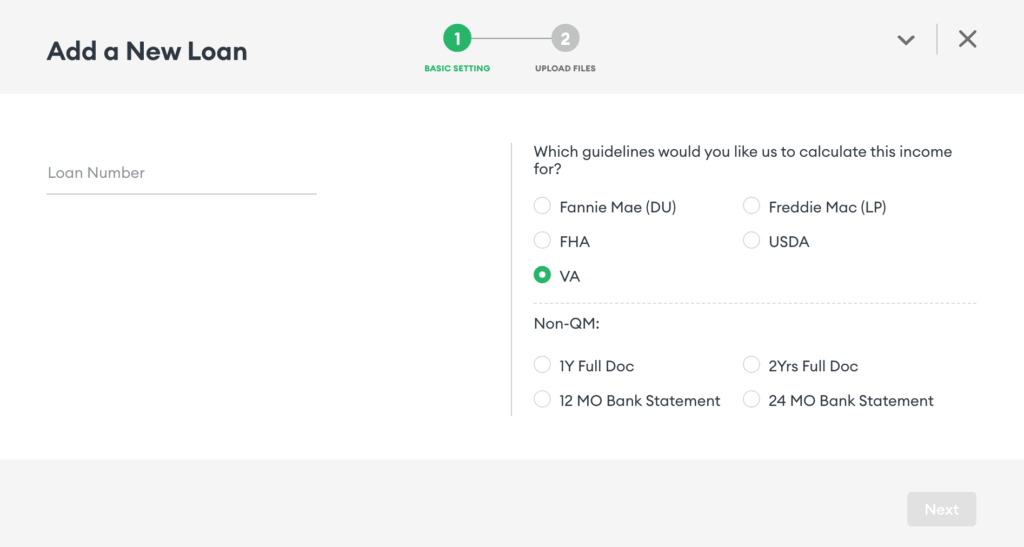

New Non-QM Guidelines: 1-Year & 2-Year Full Doc (07/15/2024)

Expanded support for complex borrower scenarios.

Built specifically for 1-Year Full Doc and 2-Year Full Doc documentation types.

New smart upload buttons simplify the process — just click and go.

Developed in collaboration with senior underwriters and mortgage tech pros for real-world accuracy.

Reduce friction and increase confidence with reliable Non-QM support.

New FHA Guidelines Now Available (10/11/2024)

Fast, accurate income analysis — built for FHA loans.

FHA-Optimized Calculations. We automatically apply the latest FHA guidelines to verify income and eligibility with confidence.

Detailed, audit-ready reports. Underwriters get clear, actionable results tailored to FHA requirements — no second-guessing.

Smarter risk assessment. Remove ambiguity with precise income breakdowns that support better decision-making.

Now Live: 12 & 24-Month Bank Statement Income Calculator (11/15/2024)

The fastest way to calculate income for self-employed borrowers.

Easily process 12- or 24-month bank statements with AI-powered precision.

Drag, drop, done. Upload statements in seconds — no manual work required.

Get consistent, audit-ready income calculations you can trust.

Cut analysis time from hours to minutes and close deals quicker.

USDA Loan Income Calculations — Now Available (11/20/2024)

Precision meets speed for rural lending programs.

Built to align with USDA guidelines — no guesswork, just reliable results.

Upload supporting documents in seconds with our optimized workflow.

Designed in collaboration with seasoned USDA underwriters for real-world accuracy.

Deliver decisions faster with automation that eliminates manual review bottlenecks.

⭐ We’re Now on Capterra, G2, GetApp & Software Advice (02/28/2025)

Rapidio is now officially listed on Capterra, G2, GetApp, and Software Advice—trusted platforms where mortgage professionals find the best solutions.

If you love using Rapidio, we’d greatly appreciate your feedback! Your review helps us improve and continue building the best automated income calculation platform.

This feature is Deployed !

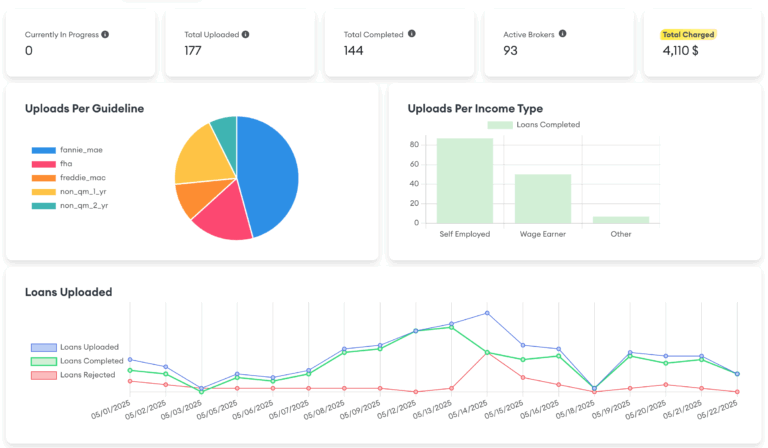

📊 New Analytics Dashboard — Know Your Numbers (02/11/2025)

Rapidio’s real-time dashboard gives you full visibility into team activity, loan volume, and cost — all in one place.

Loan Metrics — Total uploaded, completed, in-progress, and rejected loans

Guideline & Income Breakdown — See uploads by guideline (Fannie Mae, FHA, etc.) and income type (W-2, SE, Bank Statements)

Top Uploaders — Identify your most active users instantly

Cost & Usage — Track total charges and analyze spend over time

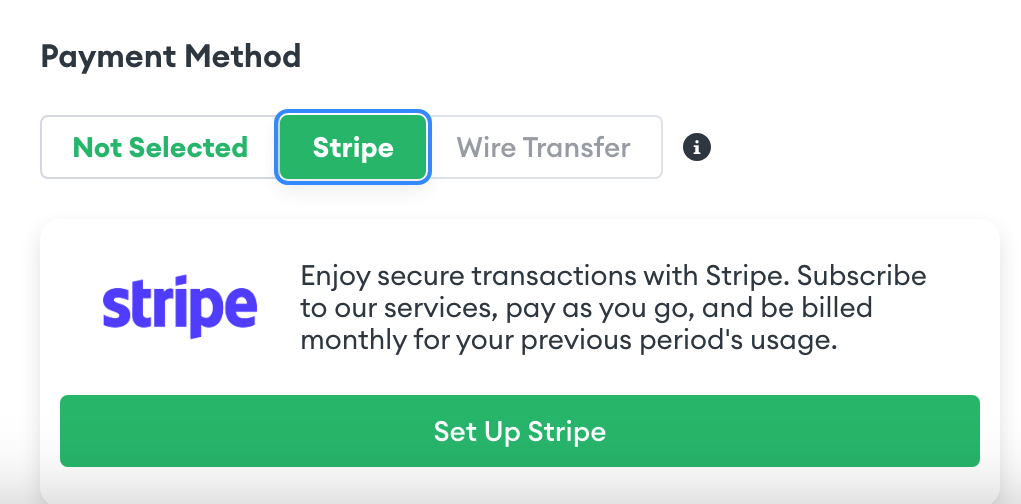

Stripe Payments — Instant Activation, No Contracts (02/15/2024)

Get started in seconds. Add your card, and unlock unlimited income calculations with no setup fees, no commitments, and no delays.

Instant Access: Add your card once — no invoicing required.

Pay As You Go: Only pay for what you use, when you use it.

Secure & Trusted: Powered by Stripe, the leading global payment processor.

🛠 Go to your portal → Settings → Organization Settings → Add Card

🤖 AI Model Upgrades — Spring 2025 Release (Coming Soon)

We’ve enhanced our proprietary AI models for even greater accuracy and speed. The latest release improves handling of edge cases like complex tax returns and handwritten documents, while reducing the need for manual intervention — meaning faster results for your team. It also features smarter red-flag detection to automatically surface missing documentation and income anomalies. One client put it best: “Rapidio is now smarter than ever — it feels like a real underwriter is watching every file.”

🔗 LOS Integration (Coming Soon)

Rapidio reports will soon be embedded directly inside one LOS, giving your team instant access to income calculations without ever leaving the LOS. With one-click uploads, smart underwriting conditions auto-attached to each file, and no need to switch tabs, your loan officers stay focused and efficient. Integration launches soon — reach out to join the pilot program.

🏛️ Fannie Mae Integration: Reps & Warrants Automation (Coming Soon)

We’re excited to be working with Fannie Mae to deliver Reps & Warrants – eligible income calculations right to your underwriting desk. This integration ensures audit-ready results that align with the latest Fannie Mae guidelines, complete with smart conditions and automated compliance. For Direct Seller/Servicers, it’s a game-changer in risk mitigation and operational speed.

🇺🇸 VA Loan Income Calculation: Simplified & Accurate (Coming Soon)

Our newly launched VA Guidelines make it easier than ever to process loans for veterans and their families. Rapidio delivers precise income calculations tailored to VA lending requirements, ensuring dependable, audit-ready results. With fast uploads of VA-specific documents and expert-reviewed automation, you’ll reduce turnaround time while maintaining full confidence in every file.

This feature is Deployed !

Unlock Exclusive Feature Updates

Gain early access to our latest feature enhancements before anyone else.