Decision-ready income calculations in minutes - with a report underwriters can trust.

🚀 Automate income review for W-2, self-employed, and bank statements. Rapidio delivers a clean income summary,

transparent calculation trail, and smart conditions – aligned with major mortgage guidelines.

<10-minute SLA for a final income report

QC-backed accuracy (human-in-the-loop)

Fannie Mae, Freddie Mac, FHA, VA, Non-QM etc

No setup fees. No monthly commitment. Start in minutes.

Works great for: Brokers, Lenders, Ops Teams, Underwriters

Trusted by Industry Leaders :

Max Slyusarchuk, AD Mortgage CEO

“We have >6,000 broker partners across 40 states that expect the best. With Rapidio, we deliver on that promise. There’s no other solution that allows cost control at the loan level. This is the future.”

Our services

-

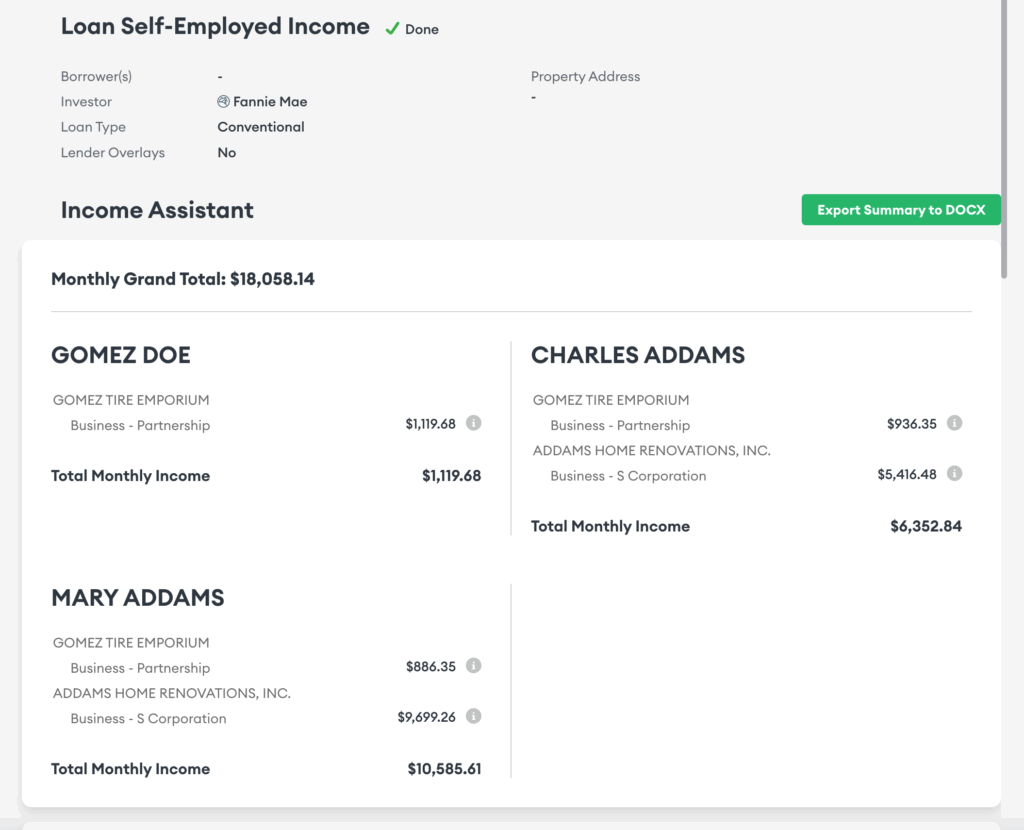

Automated Income Calculation

-

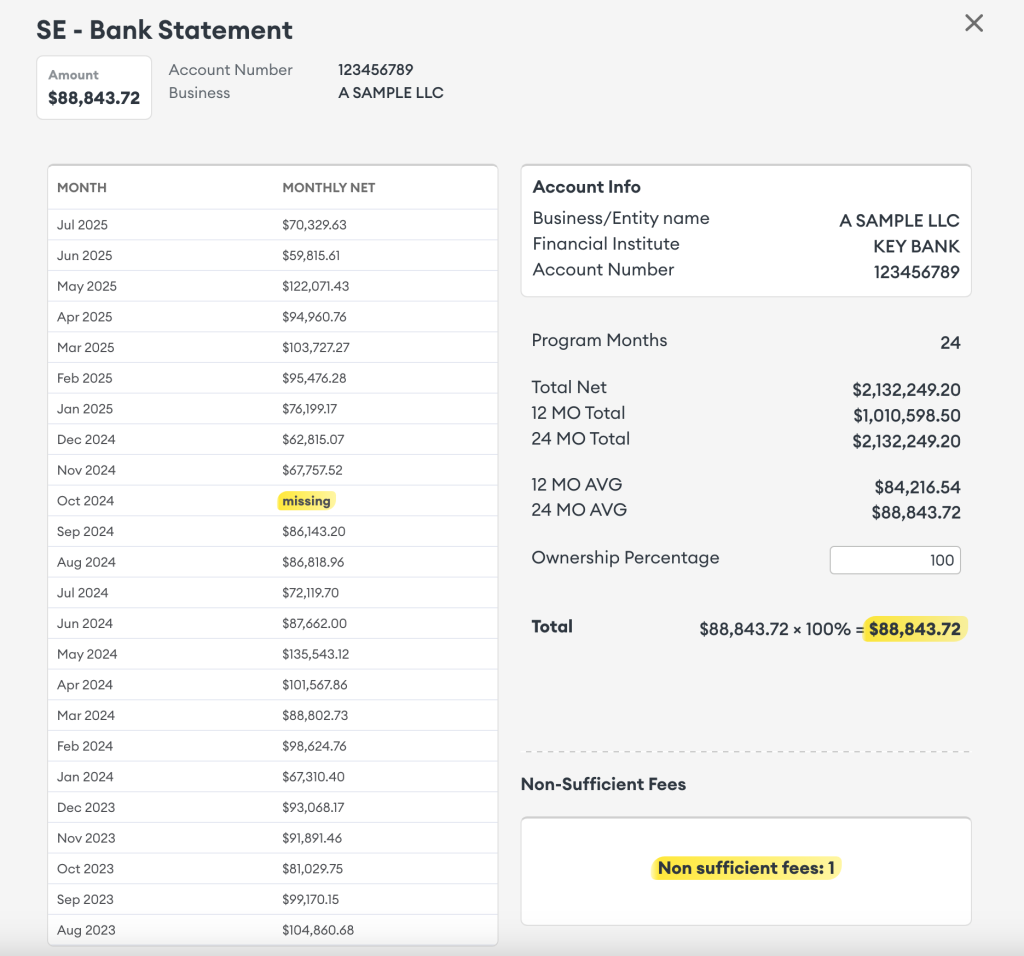

Bank Statement Income Calculation

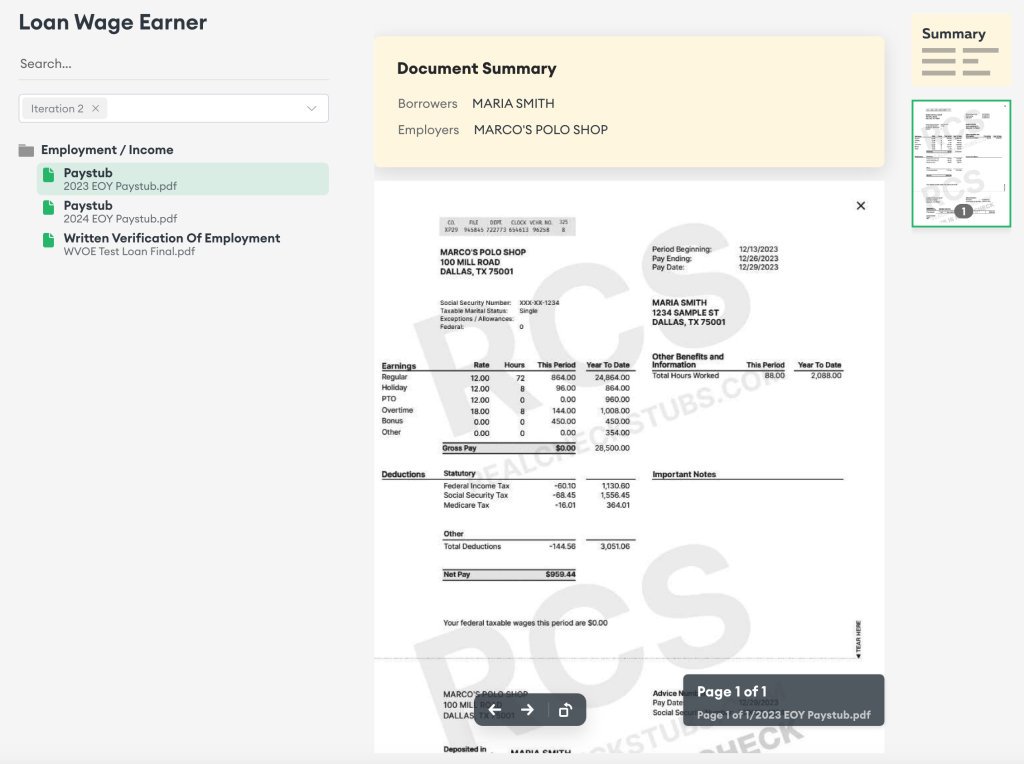

- Automated Document Classification

- Calculate qualifying income for W-2 and self-employed scenarios with a clear audit trail.

- Reduce rework with findings + smart conditions that tell your team exactly what to request next.

- Receive a final income report fast – built for “Clean File First” underwriting workflows.

- Analyze deposits, cash flow, and recurring patterns to support bank statement programs.

- Flag volatility and gaps early – so your team avoids conditions ping-pong.

- Deliver an underwriting-ready summary with a transparent calculation trail.

- Instantly organize income docs (paystubs, W-2s, tax forms, bank statements) for faster review.

- Reduce missing docs and misfiles with clear labels and file-level findings.

- Speed up processors and underwriters with a consistent, searchable document set.

How it works :

Upload Documents

Upload borrower income documents (paystubs, W-2s, tax returns, bank statements etc.) or submit them via API. Rapidio works for both manual workflows and high-volume mortgage operations.

Classify & Extract

Rapidio automatically classifies and indexes your mortgage documents, then extracts the key data needed for accurate income calculations – so your team doesn’t waste time sorting and re-keying.

Income Calculated

We apply guideline-aligned income calculation logic (Fannie Mae, Freddie Mac, FHA, VA, USDA, Non-QM etc.) and quality control review to deliver consistent outcomes across branches and reviewers.

Report + Conditions

You get a clean income summary, transparent calculation trail, and a smart conditions list your team can act on – built to support a “Clean File First” underwriting workflow.

Customers reviews

Trusted by mortgage teams:

Your volume, your price

Simple graduated tiers. The more you submit, the less you pay – every tier includes the same full-service bundle.

Pay as you go

No monthly commitmentGrowth 50

For small teams and growing brokersPro 200

For high-volume lendersFrequently Asked Questions (FAQ)

Most frequent questions and answers

Rapidio automates mortgage income calculation and income document review. You send borrower docs, and we return a decision-ready income report with a calculation trail and smart conditions.

We support common mortgage income documents including paystubs, W-2s, tax returns for self-employed borrowers, and bank statements—plus supporting documentation used in underwriting.

Yes. Rapidio supports self-employed income scenarios and produces a clear calculation trail and findings/conditions when documentation is incomplete or needs clarification.

Yes. Rapidio converts bank statements into a consistent income outcome with supporting details and smart conditions to reduce back-and-forth.

We target a final income report in under 10 minutes (depending on file type/volume). Outputs are QC-reviewed to ensure consistent, reliable income outcomes and a transparent report trail.

Yes. We provide a REST API and support asynchronous processing via polling or webhooks. We can map the workflow to your LOS/CRM or middleware so reports and conditions fit your process.

Start with 1 free credit. See your first report today!

Upload a file, get a decision-ready report with smart conditions, and validate the workflow with your team.