Get to CTC faster with trusted income calculation

Underwriter-reviewed Wage earner & Self-employed calculations in under 20 minutes!

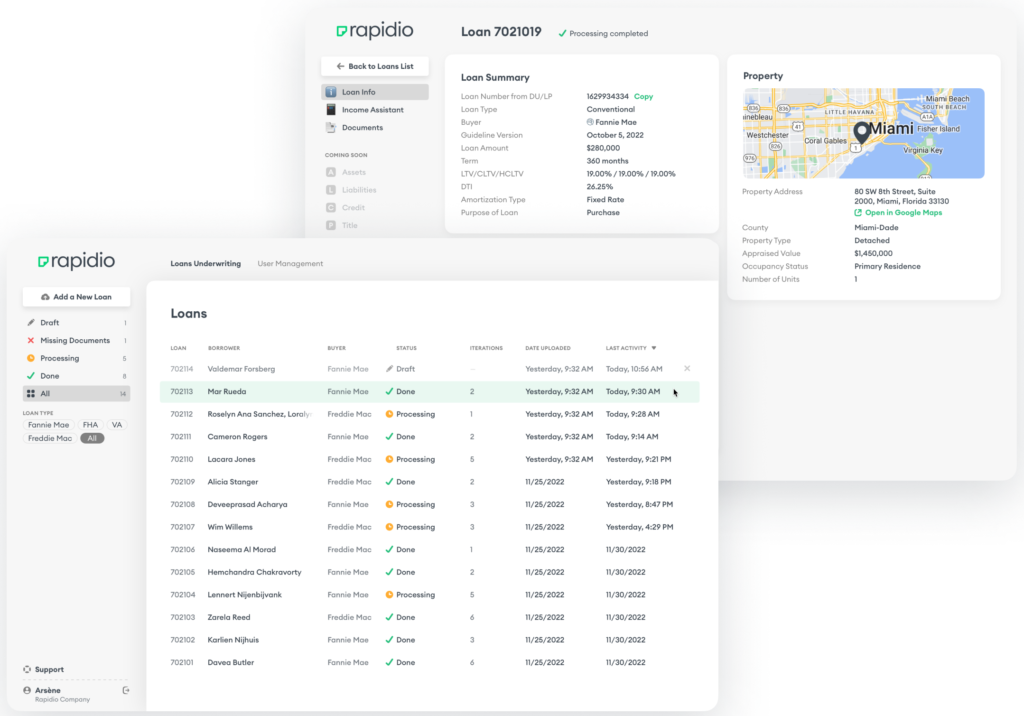

🚀 Rapidio automates wage & self-employed income under agency rules, then adds an UW for bank-level accuracy*. Brokers and lenders cut UW rework 30–40% and free 1.5–3 hours per loan.

Max Slyusarchuk, AD Mortgage CEO

“We have >6,000 broker partners across 40 states that expect the best. With Rapidio, we deliver on that promise. There’s no other solution that allows cost control at the loan level. This is the future.”

Automated Income (W-2 & Self-Employed)

Guideline-true income in minutes, human-reviewed!

Upload paystubs/W-2s or SE packages (1040 + Schedules, 1120S/1065 + K-1s). Get an underwriter-ready worksheet with transparent, line-by-line calculation, condition flags, and configurable rules (Fannie Mae, Freddie Mac, FHA, VA, USDA). Typical turnaround time <20 minutes.

Automated Bank Statement Income (12/24-mo)

No spreadsheets. No manual math. Just fast, accurate results.

Upload 12 or 24 months of bank statements and get calculated monthly income in minutes. Perfect for Non-QM and self-employed borrowers. Includes full PDF report, custom percentages, and human-verified accuracy — without the headache.

Automated Document Classification

Stop sorting PDFs by hand!

Rapidio instantly recognizes mortgage docs and assigns the correct type (W-2, paystubs, 1040s, K-1s, bank statements, VOE, etc.). Consistent labels, cleaner pipelines, fewer misroutes.

Trusted by mortgage teams:

Trusted by Leading Mortgage Companies Nationwide

Your volume, your price

Simple graduated tiers. The more you submit, the less you pay - every tier includes the same full-service bundle.

❓Frequently Asked Questions (FAQ)

How fast are results?

Most files complete in under 15 minutes; simple W-2 runs often faster. You’ll see status in real time.

How accurate is it?

Guideline-true calculation with human-in-the-loop Underwriter on every file. Transparent worksheets make audits and sign-off straightforward. If something looks off, we re-check same day — no charge.

Which guidelines do you support?

Fannie Mae, Freddie Mac, FHA, VA, USDA, plus Non-QM (including 12/24-month bank-statement programs).

Can you handle complex self-employed scenarios?

Yes — Schedule C/E/F, 1120S/1065 with K-1s, multi-business ownership, variable income, add-backs, and common edge cases. We flag anything needing UW judgment.

What do I actually get back?

Underwriter-ready income worksheet (clear calculation + notes)

Condition flags / missing docs

For bank statements: eligible deposits, NSFs/anomalies, and the calculated income

Do you integrate with our LOS/POS?

Use our web portal today; API is available. We also support secure SFTP. Ask us about your stack — we’ll connect the dots.

How do you handle security and compliance?

Encryption in transit/at rest, role-based access, audit logs, and data-retention controls. SOC 2 Type 1.

What file types work?

PDFs, scanned images, and zipped packages. Mixed orientations, multi-page, and bulk uploads are all fine.

How do we start and how long is onboarding?

Create an account (20 seconds), upload a real file, get results — typically in 14 minutes. We’ll walk your team through best practices in a 20-minute call if you’d like.

How is pricing structured?

Pay-as-you-go or subscription. Volume discounts available, plus partner discounts (AIME/NAMB). New customers usually begin with a few free credits to test on real loans.

Can we tune rules to match our overlays?

Yes — configure guideline strategy and overlays (e.g., treatment of bonuses, overtime, declining income, business add-backs). We preserve full transparency on every assumption.

What ROI should we expect?

Teams typically save 1.5–3 hours per file, cut UW rework, and speed approvals. That means more capacity on peak days and faster CTCs.