Bank-grade accuracy. Proven results you can trust. Scale throughput—without more hires

Capacity up 32–40% across branches!

See how real teams use Rapidio’s human-reviewed, guideline-transparent reports to cut UW conditions 30–40% and increase initial approvals by 5–8 percentage points. Steal the playbook and repeat the wins.

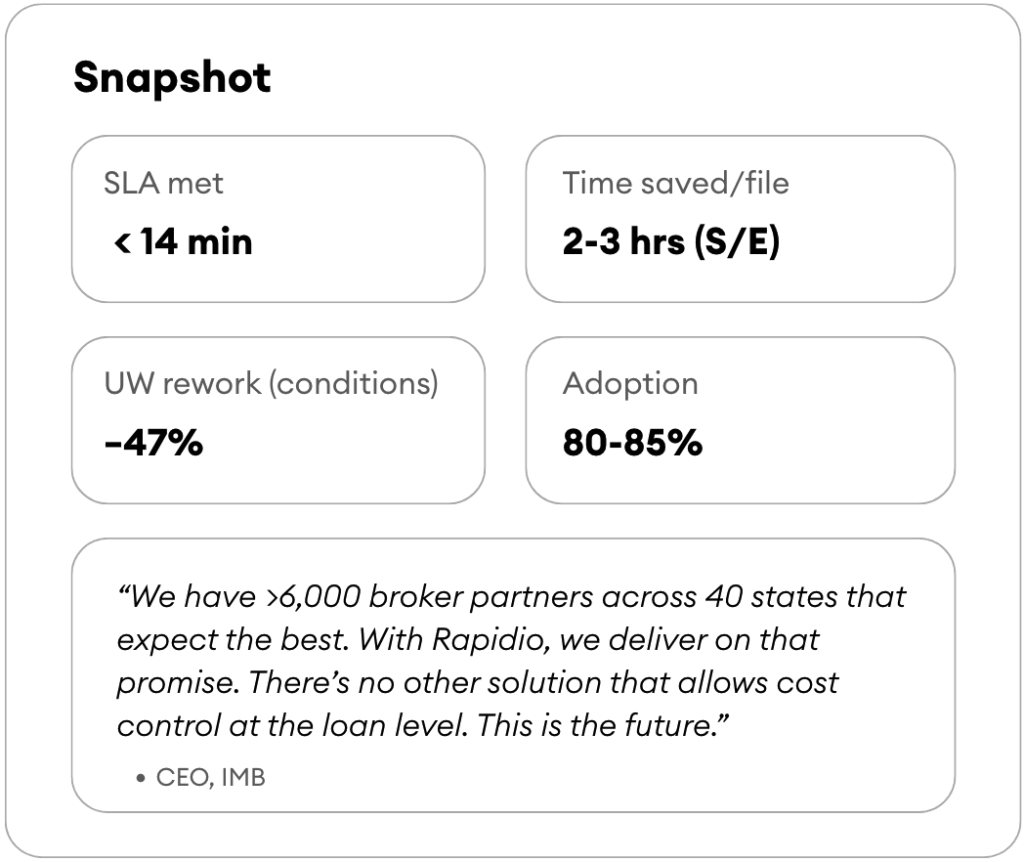

Independent Mortgage Bank boosts first-pass approvals with Rapidio

QC exceptions down 45–55%

All files finish in under 20 minutes. Audit-ready math reduces rework and accelerates sign-off, yielding 32–46% more files per processor/underwriter per week across branches.

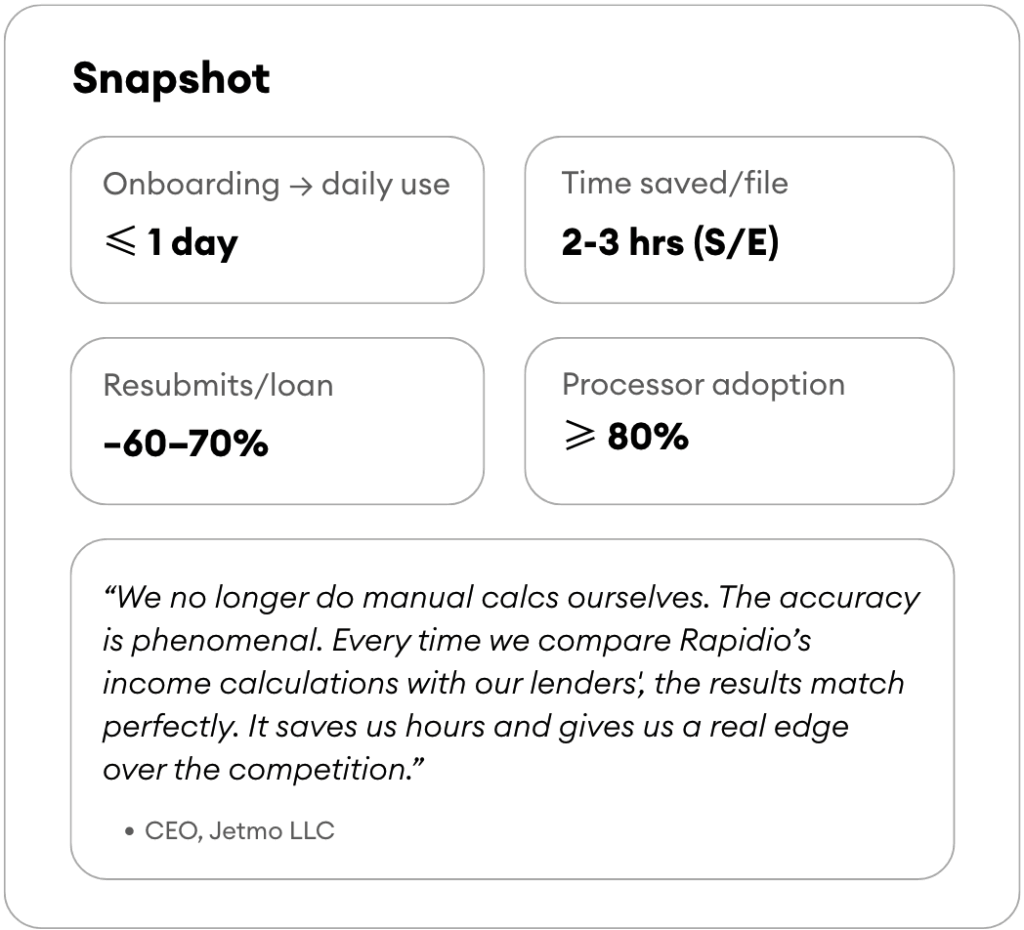

Jetmo scales throughput without new hires with Rapidio

98% of files finished in under 20 minutes!

Standardized income calculation slashes UW rework by 30–40% and makes workload capacity predictable on peak days. W-2 files run 15–21 minutes faster, self-employed 2–3 hours faster.

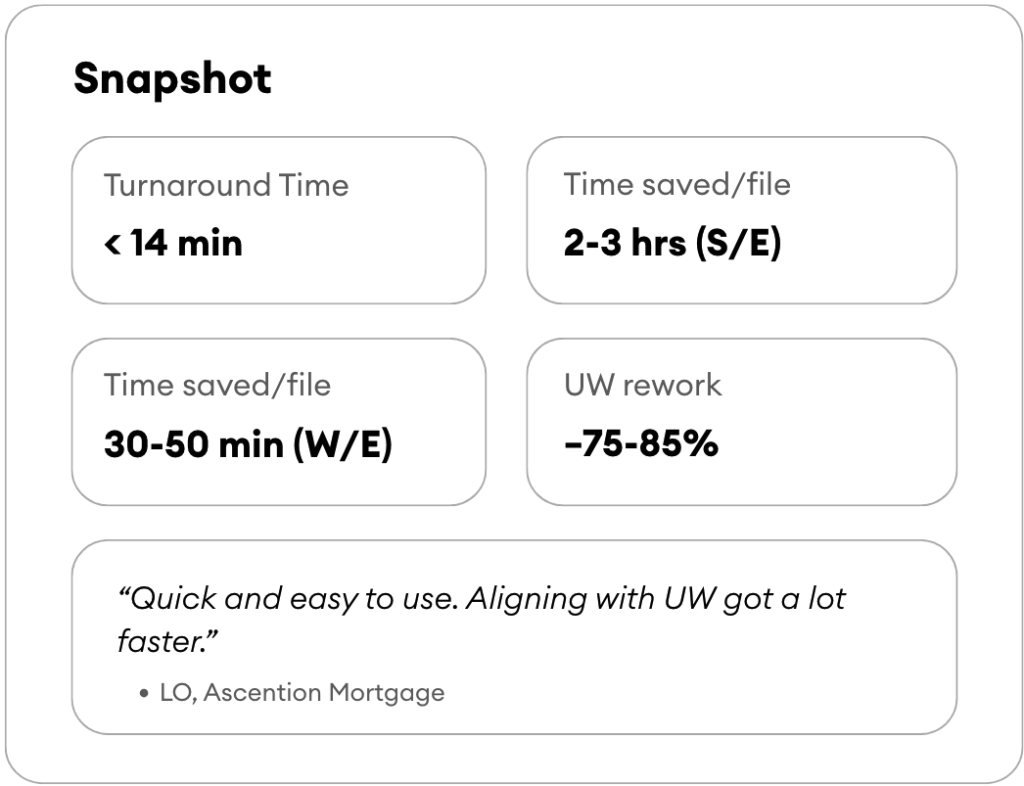

Ascension Mortgage turns complex income into UW-ready numbers with Rapidio

Turn self-employed chaos into a few minutes of clarity!

Rapidio replaces spreadsheet ping-pong with guideline-transparent math. Processors receive UW-ready reports in <20 minutes and minimize UW touches so more loans reach pre-approval the same day.

Trusted by Leading Mortgage Companies Nationwide

Trusted by mortgage teams:

❓Frequently Asked Questions (FAQ)

How are these results measured?

We track start (file upload) to finish (UW-ready report available). We publish median time, plus % of files within a <30-minute window. First-pass approvals and rework deltas come from UW feedback and internal QA samples.

Are these results typical?

They’re publish-safe ranges observed across brokers/IMBs; outcomes vary by file mix (W-2 vs self-employed), workflow, and adoption. We’ll project your numbers during a pilot and share a detailed NDA deck.

Why are some case studies anonymized?

Several deployments are white-label. To respect confidentiality, we publish anonymized cards and provide full metrics under NDA.

What’s the difference between SLA and TAT?

SLA is our commitment (e.g., “sub-30 minutes during business hours”). TAT is what actually happened on your files (median/P90). We show both to keep expectations clear.

How fast is rollout?

Most teams and brokers go live in one day. Adoption typically reaches ≥80% in 30 days with a short enablement session.

Does this work for self-employed income?

Yes. That’s where teams see the biggest gains — ~2–3 hours saved per S/E file thanks to guideline-transparent math and human-in-the-loop checks.

How do you handle security and compliance?

Encryption in transit/at rest, role-based access, audit logs, and data-retention controls. SOC 2 Type 1.

How do we try this?

Start with a short pilot (e.g., 10 files) or free credits. AIME and NAMB members get a discount. We’ll quantify your ROI and recommend the best pricing tier.

Ready to make sub-20-minute income your new normal?

Want details first? Request a security pack or see a sample report (full metrics available under NDA).