Rapidio

Blog

Insights, Tips & Tools for Modern Mortgage Teams. Stay ahead with expert guidance on AI-driven income analysis, underwriting best practices, and automation strategies for brokers, lenders, and processors.

Recent Posts

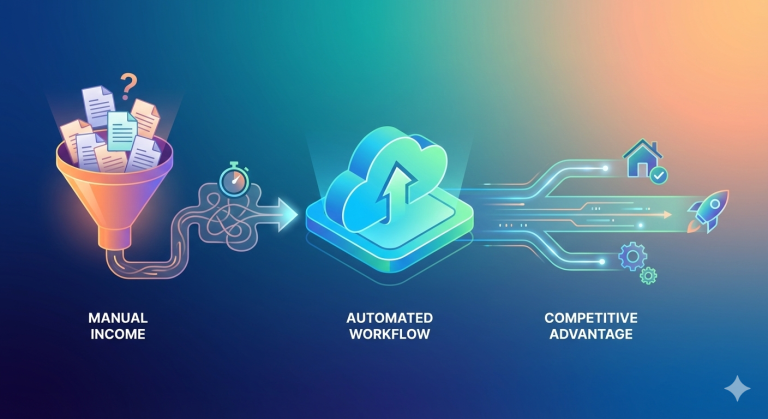

Turning Income from a Bottleneck into a Competitive Advantage for Lenders

Mortgage Workflows & Cost Turning Income from a Bottleneck into a Competitive Advantage for Lenders In today’s market, “faster” isn’t...

Read MoreHow to Use Rapidio to Standardize Income Across Branches and Channels

Mortgage Workflows & Cost How to Use Rapidio to Standardize Income Across Branches and Channels If you operate across multiple...

Read MoreBuilding a “Clean File First” Workflow: Income & Smart Conditions at the Center

Mortgage Workflows & Cost Building a “Clean File First” Workflow: Income & Smart Conditions at the Center “Clean File First”...

Read MoreFrom Application to Clear-to-Close: Where Income Automation Cuts the Most Time

Mortgage Workflows & Cost From Application to Clear-to-Close: Where Income Automation Cuts the Most Time Every lender wants faster cycle...

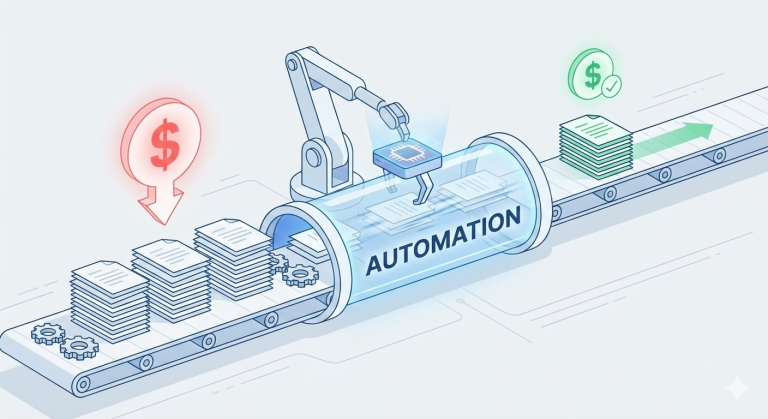

Read MoreHow Income Automation Reduces Mortgage Manufacturing Costs per Loan

Mortgage Workflows & CostCost per loan isn’t just “headcount ÷ volume.” It’s driven by touches, rework, suspense, and how many...

Read MoreVertical AI for Brokers: How Smaller Shops Can Compete with Big Banks on Speed & Accuracy

Mortgage AI StrategyBig banks have entire teams building internal tools. Brokers don’t. Yet borrowers and Realtors compare everyone on the...

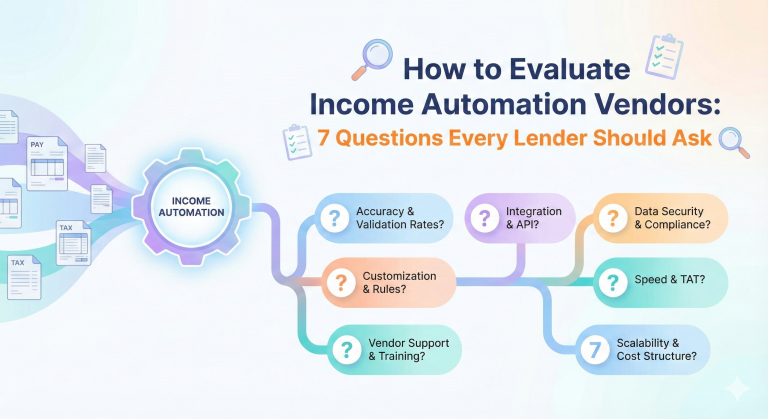

Read MoreHow to Evaluate Income Automation Vendors: 7 Questions Every Lender Should Ask

Mortgage AI Strategy How to Evaluate Income Automation Vendors: 7 Questions Every Lender Should Ask “We do AI-driven income automation”...

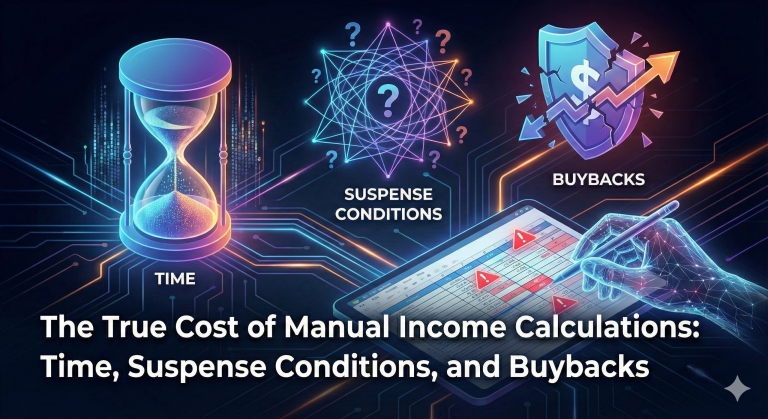

Read MoreThe True Cost of Manual Income Calculations: Time, Suspense Conditions, and Buybacks

Mortgage AI Strategy The True Cost of Manual Income Calculations: Time, Suspense Conditions, and Buybacks Most lenders know manual income...

Read MoreWhy Lenders Need a Dedicated Income & Conditions Engine (Not Just Document AI)

Mortgage AI Strategy Why Lenders Need a Dedicated Income & Conditions Engine (Not Just Document AI) “We already have AI...

Read MoreFrom Documents to Decisions: How Income Automation Changes Mortgage Economics

Mortgage AI Strategy From Documents to Decisions: How Income Automation Changes Mortgage Economics Every lender has a stack of documents....

Read MoreVertical AI for Mortgage Income: Why Generic OCR/AI Isn’t Enough for Underwriters

Mortgage AI Strategy Vertical AI for Mortgage Income: Why Generic OCR/AI Isn’t Enough for Underwriters Most “AI for documents” tools...

Read MoreFHA Variable Income: Overtime, Bonus & Shift Differential — Step-by-Step Guide

FHA Variable Income FHA Variable Income: Overtime, Bonus & Shift Differential — Step-by-Step Guide A practical, underwriter-friendly process for handling...

Read More🚀 Still Reading? It’s Time to See Rapidio in Action

You’ve read the blog. Now experience the speed, accuracy, and automation for yourself.