Decision-ready income + conditions, aligned with guidelines, with QC-backed accuracy

No contracts. No setup fees. Just results.

The fastest, most reliable way in America to get lender‑ready income — so you win the first call, pre‑underwrite every file, and close more deals. Calculate income from pay stubs, W2, tax returns, and bank statements — accurately and effortlessly.

Why Income First (and nothing bloated)

Competitors bolt on dozens of “nice‑to‑have” features. We obsess over the one thing that eats your time and kills approvals: accurate, guideline‑aligned income.

- Win the first conversation: get a confident range in minutes.

- Be lender‑ready before you submit: fewer re‑asks, fewer redraws.

- Focus = speed. No bloat—just income that funds.

What you get per file

Instant Income, Agency‑Aligned

Fannie Mae, Freddie Mac, FHA, VA, Non‑QM—with math you can audit.

Smart Conditions

Know exactly what to ask next to unlock the approval path.

Free Iterations & Re‑Runs

Docs drip at 10pm? Re‑run for free, keep momentum.

UW‑on‑File + AI

Your personal UW assistant + AI for edge cases and nuance.

Audit‑Ready Final Report

Clean math, assumptions, and guideline callouts.

Loan Officers & Brokers

Win the first call, set expectations, and stop surprises with fast, trustworthy income.

Processors & Teams

Smart Conditions mean less chasing and fewer redraws — keep files moving.

Underwriters

Clean math with citations and a manager‑proof audit trail for edge cases.

Trusted by Leading Mortgage Companies Nationwide

Outcomes that matter

- Win the call: confident income range in minutes → more apps, fewer lost leads.

- Fewer re‑asks: Smart Conditions prevent back‑and‑forth.

- Cleaner submissions: pre‑underwritten files glide through lender UW.

- Revenue up: faster cycle time = more closings per month.

Back‑of‑the‑napkin

45 hours saved / month

Reclaim ~45 minutes per file × 60 files → ~45 hours. That’s roughly one extra funded deal per week at typical pull‑through.

How it works

Step 1

Select program

Choose Fannie/Freddie/FHA/VA/Non‑QM and set assumptions for accurate alignment.

Step 2

Upload

Paystubs, W‑2s, 1099s, K‑1s, tax returns, bank statements, VOIs — whatever you have.

Step 3

Get lender‑ready income

With Smart Conditions and a clean PDF report. Need nuance? Ping your UW‑on‑file.

Why Rapidio over “platforms with everything”

Focus beats bloat. We don’t sell a kitchen sink. We ship the income engine top producers keep on speed dial.

- Accuracy you can trust (human‑in‑the‑loop when it matters).

- Speed that sells (5–30 min, file‑complexity dependent).

- Free re‑runs so you keep momentum as docs drip in.

- Smart Conditions so you walk into the lender prepared—not hopeful.

Security & Compliance

Security‑first by design

Data is encrypted in transit and at rest with strict access controls. Request our security brief on demand.

Coming soon:

- Assets

- Liabilities

- Credit

- Title

- Property

- Closing

-

Income

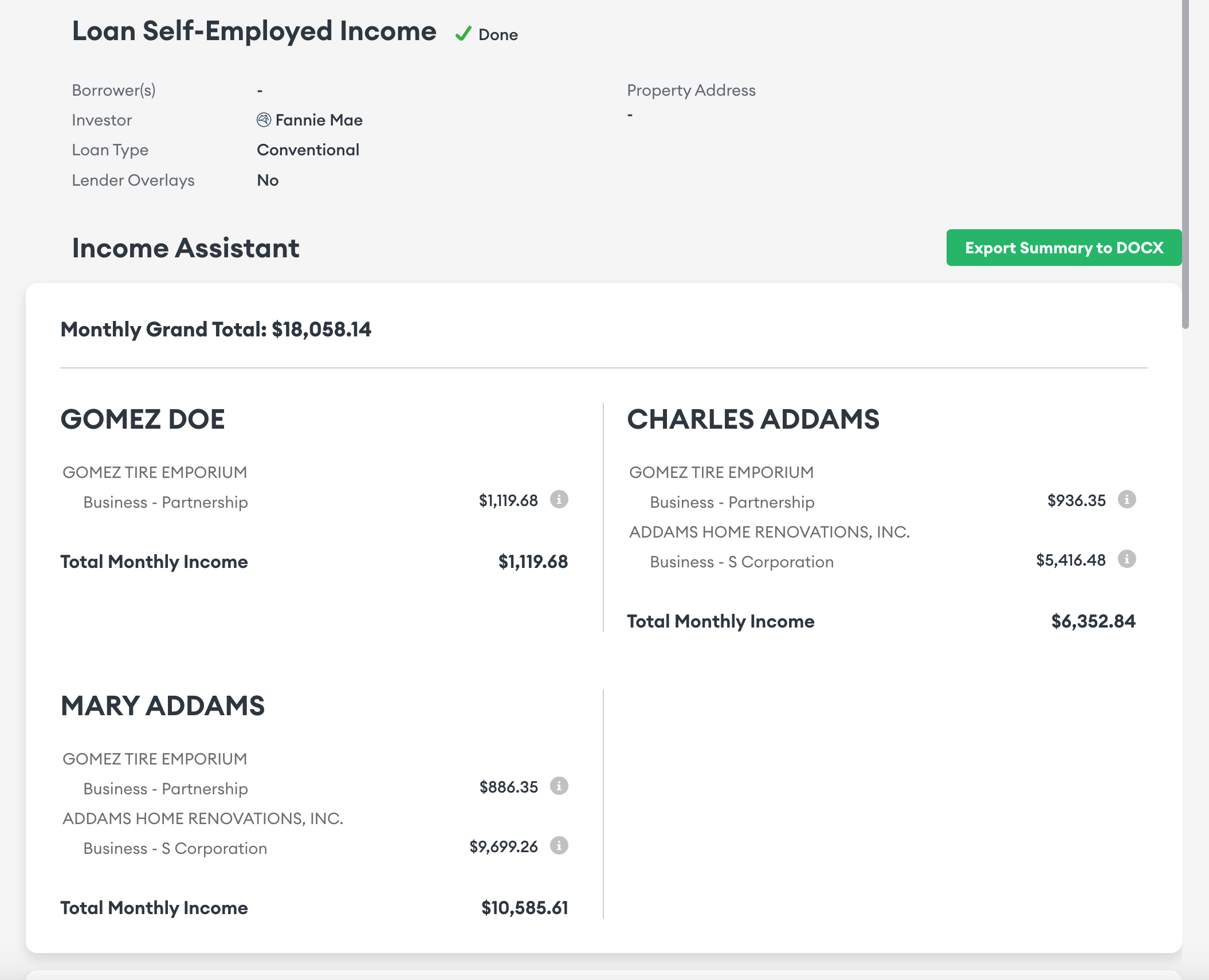

Income calculation & eligibility assessment for Non-QM, FHA, USDA, Fannie Mae & Freddie Mac

We don’t just calculate income — we deliver confidence.

From W-2s to complex tax returns, Rapidio analyzes, verifies, and packages the full income picture so your underwriter sees exactly what they need — clear, complete, and guideline-aligned.

Income drives lending decisions — and we treat it like it matters.

Every number we deliver is backed by automated logic, smart QC, and guideline validation, empowering your team to make faster, safer credit decisions with no guesswork.

Complete income coverage for Non-QM & GSE

Common Scenarios

W2 Income:

- Base Salary

- Commissions

- Overtime

- Bonus

- Seasonal

Self Employed:

- Sole Proprietor

- Partnerships

- LLCs

- C & S Corporations

Less common scenarios

- Interest & Dividend

- Capital Gains

- Farming

- Rental Property

- Trust

- Royalty Payments

- Retirement

- Social Security Retirement

- Disability

- Foster Care

- Alimony

- Separate Maintenance

- Child Support

- Public Assistance

- Temporary Leave

- Foreign

- Tips

- Automobile Allowances

- Housing or Parsonage Allowances

- Military

- VA Benefit

- Notes Receivable

- Mortgage Credit

- Certificates / Mortgage Differential Payments Credits

Calculate Income Like an Underwriter — In Minutes

See Rapidio in Action

Max Slyusarchuk, AD Mortgage CEO

“We have >6,000 broker partners across 40 states that expect the best. With Rapidio, we deliver on that promise. There’s no other solution that allows cost control at the loan level. This is the future.”

❓Frequently Asked Questions (FAQ)

What types of income can Rapidio calculate?

We support W-2 income, paystubs, self-employed income (1099s, tax returns, bank statements), Social Security, retirement, pension, and more.

Does your tool generate full income reports?

Yes. You’ll receive a downloadable PDF report that includes income breakdown by borrower and type, Smart Conditions, and supporting doc references.

What are Smart Conditions and how do they help?

Smart Conditions are automatically generated based on income type and selected guidelines. They help underwriters flag risks and reduce back-and-forth.

Can the income logic be customized to our overlays?

Yes — we can tailor the guideline rules and conditions to match your internal underwriting overlays and compliance policies.

Is the Bank Statement Calculator customizable?

Absolutely. You can select default income percentage (e.g., 50%, 65%, 80%) and override it manually if needed. Check it here.

Who uses this tool — underwriters or brokers?

Both. Brokers use it at the application stage, while underwriters rely on it for income validation and QC at pre-close and final review.

Can we bulk upload loans or automate flow?

Yes. We offer bulk upload support and API access for full automation — ideal for high-volume lenders.

How accurate is your income engine?

Our system combines AI with Human-in-the-Loop QC for 99.99% accuracy — ensuring reliable, audit-ready results.

Can I get notifications when my income report is ready?

Yes. You’ll receive email alerts and see real-time status updates in the portal when your loan is processed.

How long does it take to get results?

Most reports are completed within 14 minutes, including Smart Conditions and PDF output.