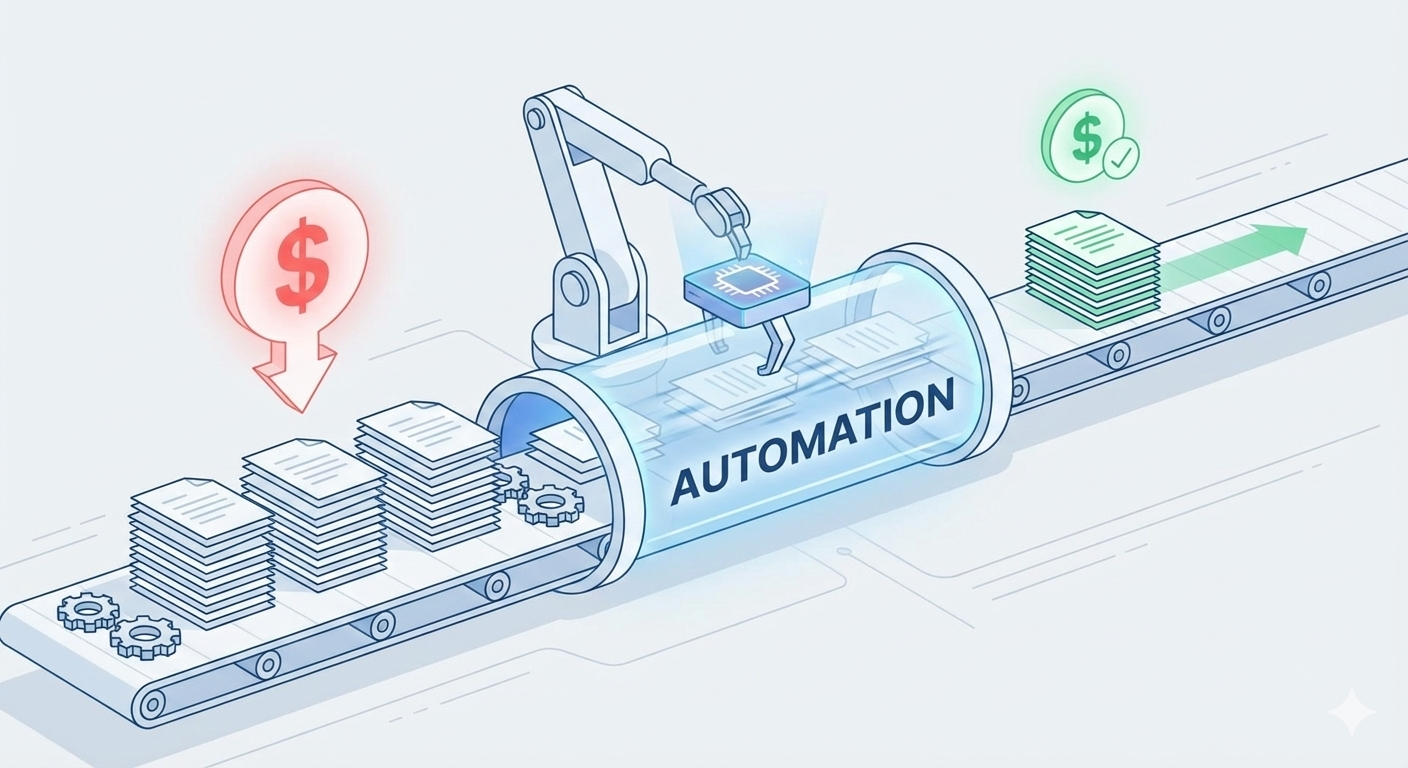

Cost per loan isn’t just “headcount ÷ volume.” It’s driven by touches, rework, suspense, and how many times your most expensive people (UWs + processors) have to rebuild income. Income automation reduces manufacturing cost by removing the most repeatable, time-heavy, and error-prone work — without sacrificing guideline rigor.

1. What “mortgage manufacturing cost” really includes

Most lenders track cost per loan as a finance metric. Operationally, it’s simpler: how many human minutes you spend per funded loan, multiplied by the cost of those minutes. The most common cost components are:

- Underwriting time (income, conditions, re-review, investor clarifications)

- Processor time (collecting docs, building worksheets, chasing missing items)

- Rework cycles (touches caused by income disagreements or late findings)

- Suspense / fallout (loans delayed or lost due to conditions discovered too late)

- QC & post-close (cures, defects, investor questions, repurchase risk)

2. Why income is the highest-leverage cost driver

Income is unique because it is:

Every loan needs it. Even “simple” files create rules + conditions.

It consumes underwriter and processor attention — your most expensive minutes.

Small errors become suspense, cures, or defects after closing.

Generic document AI may help extract data, but it typically doesn’t deliver what actually reduces cost: guideline-aware calculations and Smart Conditions that prevent rework.

3. The 4 cost levers income automation moves

3.1 Underwriter minutes per file

When UWs receive a guideline-ready income report with clear math and conditions, they shift from “rebuild” to “review.” That’s where the big capacity gain comes from.

3.2 Touches (rework loops)

Income automation reduces the classic “ping-pong” loop: LO → processor → UW → processor → borrower → UW. Fewer loops = lower cost and faster cycle time.

3.3 Suspense caused by income

Smart Conditions catch missing docs, gaps, declines, and inconsistencies earlier — before the file hits underwriting or investor review. That reduces suspense delays and late-stage chaos.

3.4 Defects, cures, and buyback tail risk

Standardized calculations and auditable rationale reduce “interpretation drift” across teams. That lowers post-close issues tied to income treatment.

4. Before vs after: what changes in day-to-day work

| Workflow Area | Before (Manual / Spreadsheet) | After (Income Automation) |

|---|---|---|

| Income calculation | Multiple versions of “truth,” rebuilt by each UW | One standard income report, guideline-aware math |

| Conditions | Written manually, inconsistent across UWs | Smart Conditions generated consistently and early |

| Rework | Multiple touches per file to reconcile differences | Fewer touches; UWs validate instead of rebuild |

| Cycle time | Delays from suspense and “one more doc” surprises | Cleaner files upstream, faster movement to CTC |

| QC / audit | Hard to explain decisions; defects show up late | Auditable rationale + math reduce defects and cures |

5. A simple model to estimate savings per loan

Use this quick method to estimate impact:

- Measure current UW income time (minutes per file, average)

- Measure rework touches (how many re-reviews are income-driven)

- Estimate suspense impact (how many files per month get delayed due to income)

- Calculate loaded cost per hour for UW + processor time

Even conservative improvements (e.g., saving 20–30 minutes of UW time and removing one rework loop) can materially reduce manufacturing cost — especially at scale.

6. How to roll out income automation without breaking ops

The best rollouts are narrow and measurable:

- Start with a pilot segment (FHA/VA, self-employed, one channel, or one branch)

- Run in parallel for 2–4 weeks (compare outputs and time saved)

- Involve UWs early (trust comes from transparency and control)

- Standardize the report as the source of truth for that segment

- Expand product-by-product once metrics prove it

7. What to demand from an income automation partner

If your goal is reducing cost per loan (not just “trying AI”), require:

- Guideline-aware income decisions (not only extraction)

- Full transparency (math, lookbacks, rationale)

- Smart Conditions that mirror underwriting language

- Human-in-the-loop QC for messy docs and edge cases

- Practical integration (portal first, API/LOS later)

- ROI measurement (time per file, touches, suspense, defects)

Income automation works when it becomes a standard operating layer — a real engine — not another tool your team works around.

Pick 10 recent loans (include 3–5 complex income files). Run them through Rapidio alongside your current process and compare UW time, touches, and conditions. You’ll see quickly what changes.