Rapidio: The Fastest, Most Accurate AI Mortgage Income Calculation Platform

If you’re a mortgage professional — loan officer, processor, underwriter, or broker — you know that calculating borrower income is one of the most time-consuming, complex, and error-prone parts of the mortgage process.

Manual income calculation leads to delays, underwriting conditions, or even costly buybacks.

That’s why more and more lenders are turning to AI mortgage income calculation — and why Rapidio is quickly becoming the go-to automated mortgage income calculator for modern mortgage teams.

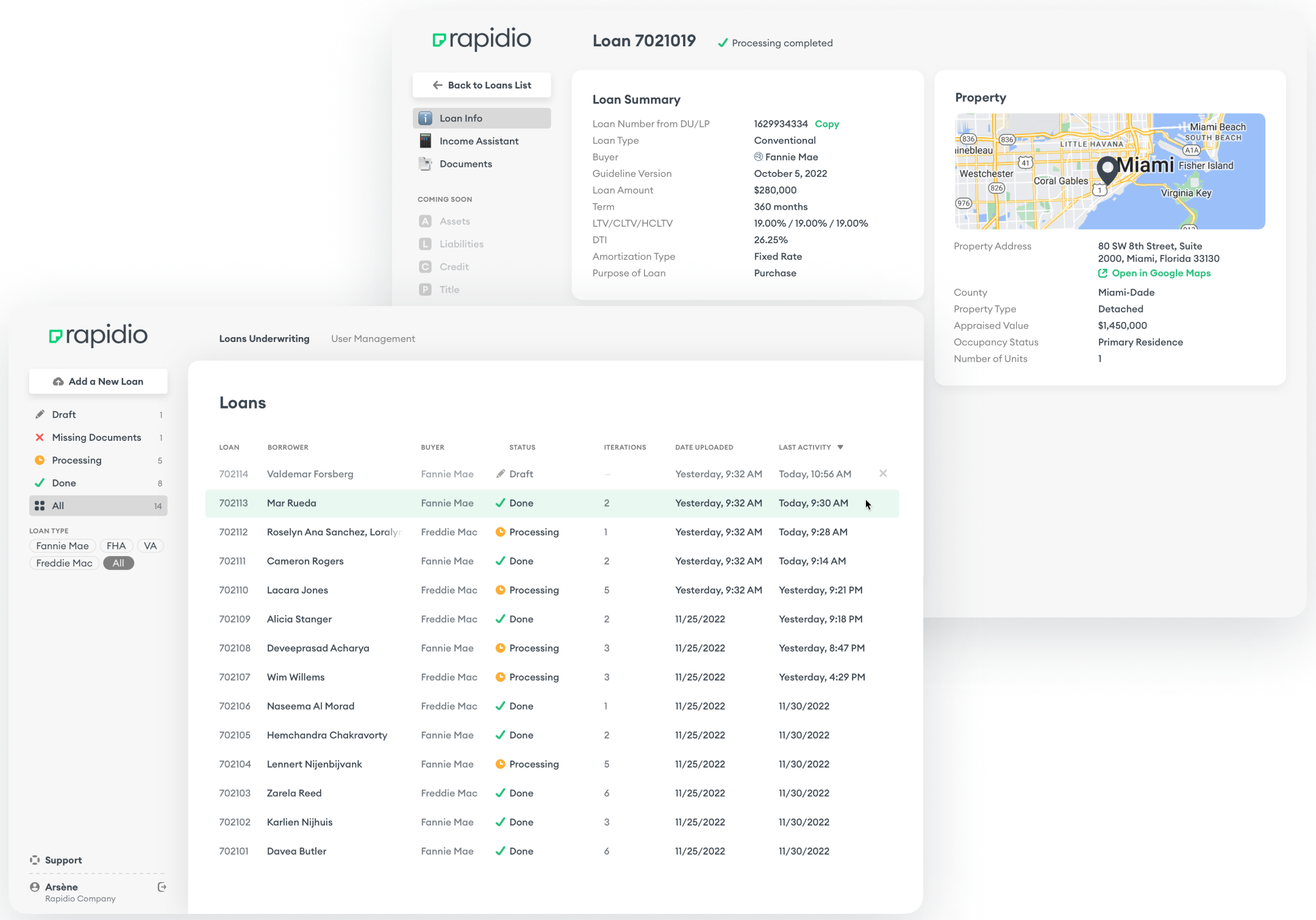

What Is Rapidio?

Rapidio is an advanced AI-powered mortgage income calculation software that helps mortgage professionals process files faster, more accurately, and with fewer surprises in underwriting.

Our platform uses cutting-edge AI technology to:

✅ Perform AI document classification for mortgages, reading and correctly naming each document

✅ Extract income data from every document

✅ Apply the correct income calculation based on investor guidelines and number of years of documents provided

✅ Generate Smart Conditions for mortgage files — helping you know what’s missing and what will get you into underwriting faster

✅ Deliver underwriter-ready income calculations with an average turnaround of just 17 minutes per file

What Types of Income Does Rapidio Support?

Rapidio’s automated mortgage income calculator supports a full range of complex income types, including:

- Wage earner income — including variable pay, bonuses, commissions, and overtime

- Self-employed mortgage income calculation — covering sole proprietors, 1099 borrowers, and more

- Business income

- Retirement income

- Rental income & lease agreements

- Bank statement income analysis

No matter how complex your borrower’s income situation is, Rapidio can handle the analysis with speed and accuracy.

AI Document Classification for Mortgages

One of the most powerful features of Rapidio is our AI document classification for mortgages.

Our system automatically reads, identifies, and organizes uploaded documents — whether they’re paystubs, tax returns, VOEs, lease agreements, or bank statements.

This automated document classification saves processors and underwriters countless hours per file — ensuring faster processing and fewer errors.

Smart Conditions: Stay Ahead of Underwriting

Our platform generates Smart Conditions on every file, helping you:

✅ Identify missing documents early

✅ Understand potential underwriter flags

✅ Clear conditions proactively

✅ Reduce time-to-close

With Smart Conditions for mortgage files, your loans move faster through the pipeline — giving you a competitive edge.

Customizable to Your Business Needs

Every lender has different processes and overlays. That’s why Rapidio offers full customization options:

- Guideline overlays — customize for your internal rules

- Platform integrations — API integrations with your LOS, POS, CRM, and other tools

- Whitelabel options — present Rapidio as your own branded solution

Affordable, Simple Pricing

Rapidio is the most affordable AI-powered mortgage income calculation software on the market:

- $30 per wage earner file

- $35 per self-employed file

- Discounted Rates for Members

- No limits on borrowers, income types, or number of documents per file

Fast Mortgage Income Calculation — with Human Accuracy

While many automated income analysis mortgage tools rely 100% on AI, Rapidio includes a human-in-the-loop approach:

✅ Every file is reviewed by our human QC team

✅ QC staff are available via email for questions

✅ Files are completed with an average turnaround of 17 minutes

This ensures the best of both worlds: fast mortgage income calculation powered by AI, with human-reviewed accuracy you can trust.

Who Uses Rapidio?

Rapidio is trusted by mortgage professionals across the industry:

- Mortgage brokers

- Direct lenders

- Loan officers

- Underwriters

- Processors

- QC departments

If you need faster, more accurate income calculation and document classification — Rapidio is the ideal tool for your team.

Get Started with Rapidio Today

Stop wasting time on manual income calculation.

Experience the power of AI mortgage income calculation, automated document classification, and smart conditions for mortgage loans — all with unbeatable pricing and human-reviewed accuracy.

👉 Contact us today to schedule a demo or start your free trial of Rapidio, the best automated mortgage income calculator on the market.