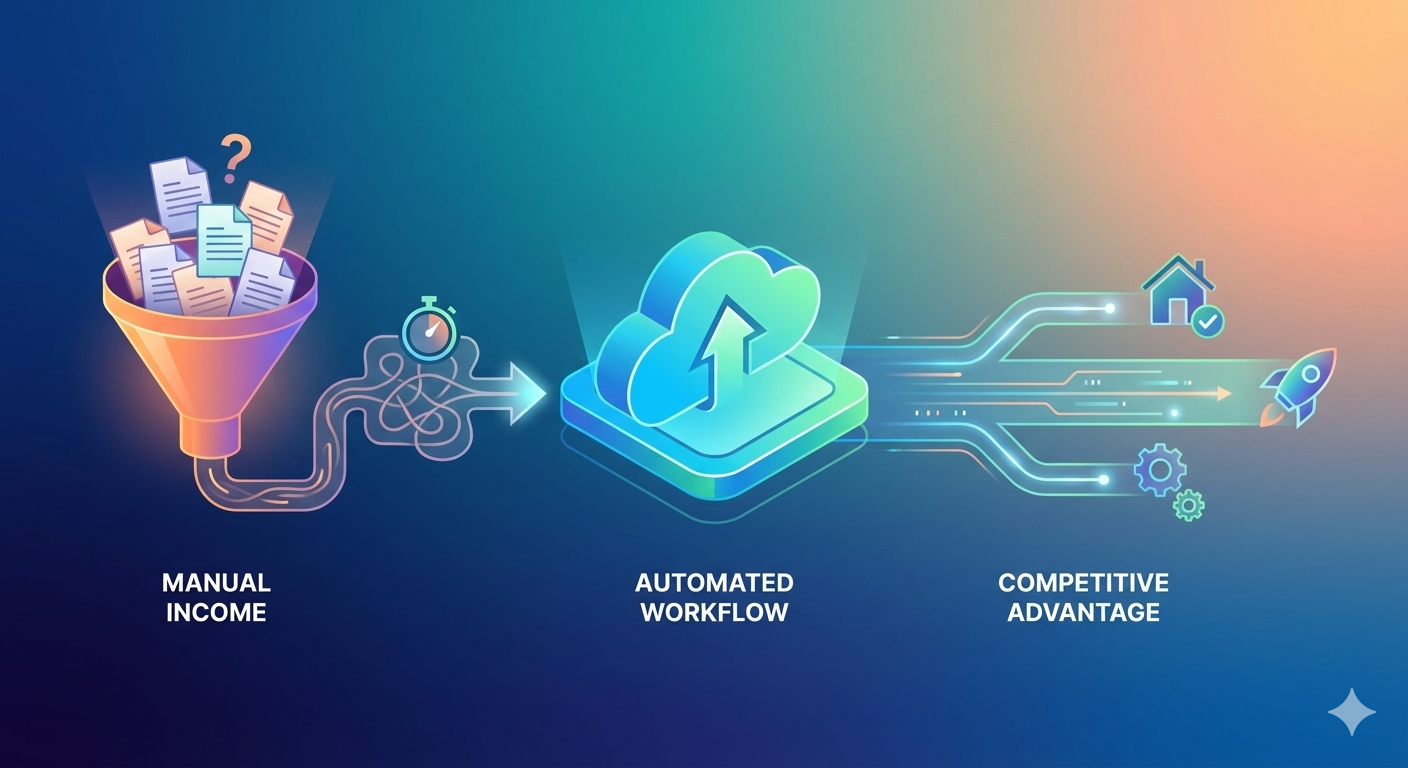

Turning Income from a Bottleneck into a Competitive Advantage for Lenders

In today’s market, “faster” isn’t a nice-to-have - it’s a competitive weapon. But most lenders still treat income as a slow, manual, spreadsheet-heavy step that lives inside underwriting. The lenders that win are doing something different: they’re turning income into an upstream engine that improves speed, file quality, and cost per loan - all at once.

1. Why income is still the #1 operational bottleneck

Income slows lending down because it combines three hard things in one step:

Complex rules

FHA, VA, GSEs, non-QM, overlays - the rules change by product and scenario.

Messy data

Pay stubs, bank statements, tax returns, VOEs, gaps, declines - docs rarely arrive “clean.”

High cost minutes

Underwriters (your most expensive time) often rebuild income instead of reviewing decisions.

When income stays inside underwriting, it becomes a queue problem: files pile up, conditions are discovered late, and CTC becomes unpredictable.

2. The 4 competitive advantages income automation creates

2.1 Faster decisions (and fewer reversals)

Automated, guideline-aware income enables earlier confidence at pre-qual and initial UW - reducing the painful scenario where a file gets “approved” and later the income changes.

2.2 Cleaner files (lower suspense, fewer touches)

Smart Conditions catch missing documents, gaps, and inconsistencies earlier - so you clear the right items before the file becomes a suspense case.

2.3 More capacity without hiring

When underwriters validate standardized income reports instead of rebuilding them, throughput increases - and queue time decreases.

2.4 Stronger defensibility (lower defect and cure risk)

Transparent calculations and auditable rationale reduce post-close “why did you treat it that way?” moments - especially across branches and teams.

3. ROI in plain English: where the savings really come from

Income automation ROI is not “AI savings.” It’s manufacturing savings.

It shows up as fewer minutes, fewer touches, fewer suspense days, and fewer defects.

- Minutes: less UW time spent rebuilding income

- Touches: fewer re-reviews and back-and-forth loops

- Suspense: fewer income-driven suspense conditions and faster clearance

- Quality: fewer income-related defects/cures and stronger audit trails

Multiply small improvements across volume and you get a meaningful reduction in cost per loan - while improving speed.

3.1 A simple ROI model you can run this week

Pick 20 recently funded loans and measure:

- Average underwriter minutes spent on income

- Number of income-driven re-review touches

- Income-related suspense rate and days in suspense

Then rerun those same loans through an income engine and compare. That delta is your near-term ROI - and it’s usually larger than teams expect.

4. A new operating model: income as a shared service layer

Top-performing lenders are shifting income out of “each underwriter does it their way” into a standardized service layer that supports every channel:

- Retail branches

- Wholesale and broker channels

- Correspondent partners

- Specialty products and niche programs

This reduces variance across teams and creates one consistent interpretation of income that everyone can rely on.

5. The lender playbook: how to turn income into a weapon

- Move income earlier (intake / pre-qual), not only inside underwriting.

- Standardize the output (one report format across teams).

- Use Smart Conditions upstream so processors clear high-impact items before UW.

- Measure touches - every re-review is cost and delay.

- Scale by channel once KPIs move.

6. What to measure: KPIs that prove advantage

Track before vs after:

- Time to initial underwriting decision

- Income-driven suspense rate + days in suspense

- Underwriter minutes spent on income per file

- Touches per file (income-driven re-reviews)

- Time from conditional approval to CTC

- Income-related defects/cures

- Cost per loan (minutes × loaded cost)

When these move together, income stops being a bottleneck - and becomes a measurable advantage.

Choose 20 loans (include complex income). Run a parallel test with Rapidio. We’ll compare UW minutes, touches, suspense days, and condition quality - and put a dollar value on the difference.