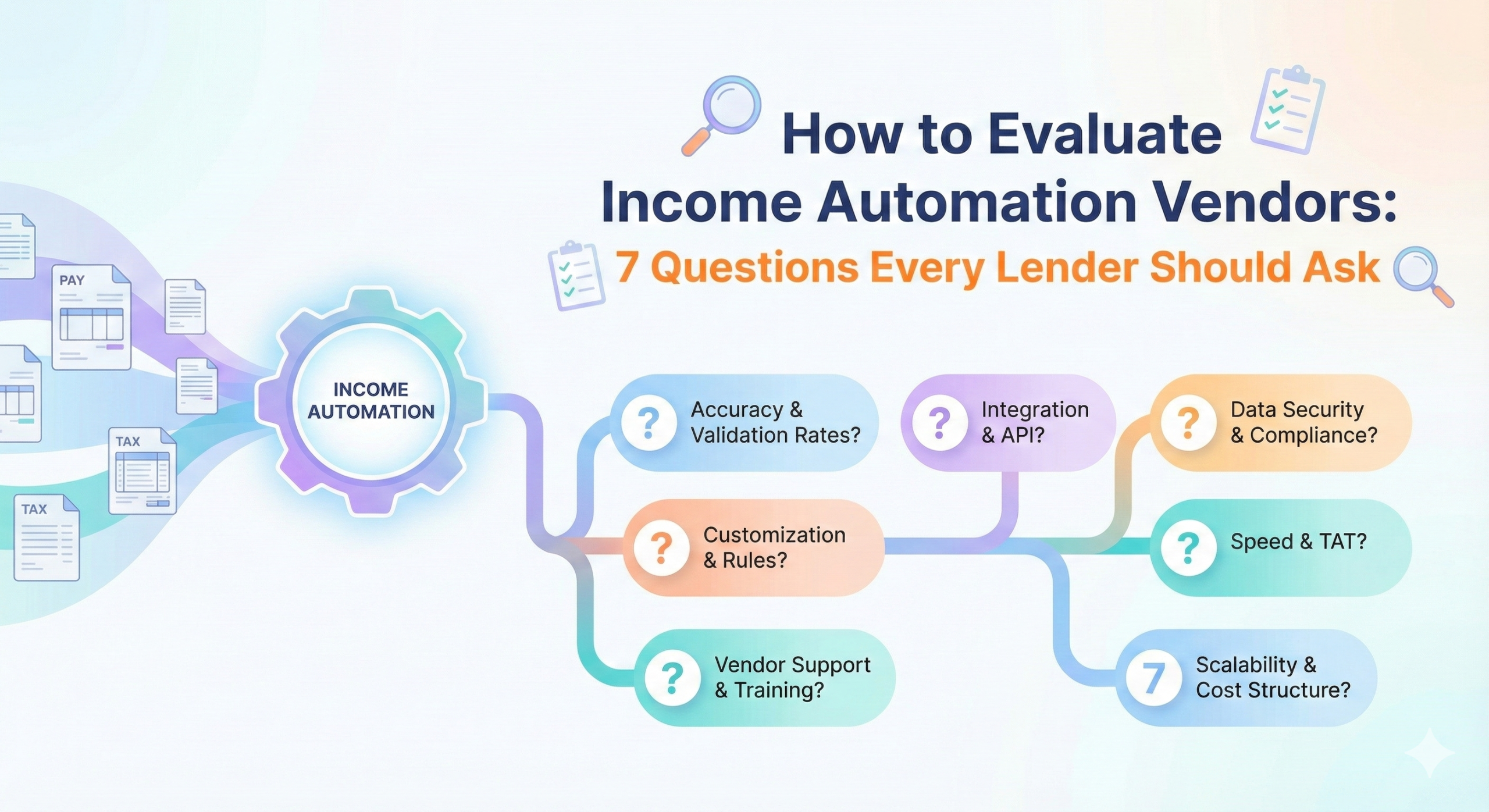

How to Evaluate Income Automation Vendors: 7 Questions Every Lender Should Ask

“We do AI-driven income automation” has become a standard line in vendor decks. But behind the slides, capabilities vary wildly. Some tools only read documents. Others act as a true income & conditions engine. These seven questions will help you tell the difference — before you commit your pipeline to the wrong partner.

1. Why you need a sharper checklist for “income AI”

The market is crowded. Document AI vendors, OCR platforms, LOS add-ons, and niche startups all claim to “automate income.” Without a clear framework, it’s easy to:

- Buy a tool that only extracts data but doesn’t make defendable decisions.

- End up with an “AI layer” that your underwriters don’t trust and always override.

- Invest in a platform that can’t keep up with guideline changes or niche products.

The goal of this checklist is simple: help you find a vendor that behaves like a dedicated income & Smart Conditions engine, not just a fancy scanner.

2. Question 1 – Are you a vertical income engine or a generic doc AI?

What to ask:

- “Which industries do you serve?”

- “How much of your business is mortgage and consumer lending?”

- “Do you support income for FHA, VA, GSE, non-QM, reverse, DSCR, etc.?”

What you’re looking for:

- A clear focus on lending and mortgage, not 10 unrelated verticals.

- Evidence they’ve built domain-specific logic, not just templates for a few forms.

- Language that sounds like your underwriters, not generic “AI for documents” marketing.

A true income automation vendor talks about FHA, VA, GSEs, and overlays as first-class citizens, not edge cases.

3. Question 2 – How do you handle FHA, VA, GSE, and product guidelines?

What to ask:

- “Where does your guideline logic live? Can you show it to us at a high level?”

- “How do you update FHA, VA, Fannie, Freddie, and investor overlays when they change?”

- “Can we configure lender-specific overlays and see where they apply in the calculation?”

What you’re looking for:

- Concrete description of guideline packs or rule libraries.

- A clear process for staying current with agency changes.

- Support for your own overlays with traceability (what rule came from whom).

If a vendor can’t clearly articulate how they encode and maintain guidelines, your underwriters will end up treating the system as “just another opinion,” not a source of truth.

4. Question 3 – How transparent and auditable are your calculations?

What to ask:

- “Can we see the full math behind each income decision, not just the final number?”

- “How are lookback periods, averaging logic, and stability checks documented?”

- “Can we export the calculations for audit or investor reviews?”

What you’re looking for:

- A clear, human-readable report that shows:

- each income source,

- how it was averaged,

- which months/years were used,

- and why some sources were excluded.

- Ability for underwriters to drill into assumptions and adjust if needed.

- Export options for QC, audit, and investor conversations.

If the system is a black box, your best people will not trust it. Transparency is non-negotiable for both adoption and risk management.

5. Question 4 – Do you generate Smart Conditions or just flags?

What to ask:

- “What does the system output beyond the income number?”

- “Do you generate underwriter-style conditions, or only generic warnings?”

- “Can conditions be tailored to our credit policy and investor expectations?”

What you’re looking for:

- Conditions that sound like a UW wrote them:

- “Provide 24 months of bonus history to support inclusion of bonus income,” not “Warning: low history”.

- Coverage for common issues: missing docs, gaps, declines, inconsistencies, high-risk patterns.

- Ability to map conditions into your LOS and pre-UW checklists.

Flags are easy to generate and easy to ignore. Smart Conditions directly change file quality, suspense rates, and investor confidence.

6. Question 5 – What does your human-in-the-loop and QC model look like?

What to ask:

- “How do you handle messy, non-standard, or low-quality documents?”

- “Do humans review files? If so, when and how is that process controlled?”

- “What SLAs and accuracy guarantees can you commit to?”

What you’re looking for:

- A clear explanation of human-in-the-loop for edge cases and low-confidence outputs.

- Defined QC checks that run before the file is returned to you.

- Service-level expectations for turnaround time and quality.

Pure automation is a myth for complex income. The question is whether the vendor has an organized, measurable QC layer — or whether all exceptions spill back onto your team.

7. Question 6 – How do you integrate with our LOS, POS, and doc flow?

What to ask:

- “How do docs get from our LOS/POS into your system?”

- “How do results get back — PDF reports, data fields, conditions, all of the above?”

- “What does implementation look like for a mid-size lender vs. a large IMB?”

What you’re looking for:

- Multiple integration paths: direct LOS integration, SFTP/API, and secure web portal.

- Minimal IT lift for initial rollout, especially for pilot programs.

- Support for different channels (retail, wholesale, broker, reverse) without separate projects.

A strong vendor will meet you where you are: starting with a simple workflow and growing into deeper integrations once value is proven.

8. Question 7 – Can you prove ROI with real metrics and references?

What to ask:

- “What impact have you had on time per file, suspense rates, or loans per UW?”

- “Can you share anonymized before/after data or case studies?”

- “Can we talk to existing customers that look like us?”

What you’re looking for:

- Specific before/after metrics, not vague statements.

- Case studies with complex income profiles, not just simple W-2 scenarios.

- Referrals from organizations with similar products, volume, and channels.

If a vendor can’t point to measurable improvements in capacity, suspense, or risk, you’re likely paying for a tool your team will quietly work around.

9. How to run a practical vendor evaluation (without derailing ops)

Once you’ve shortlisted vendors using the seven questions, the next step is a controlled trial on real files. You don’t need a six-month project.

Here’s a simple pattern:

- Step 1 – Pick a cohort of files

30–50 loans with a mix of W-2, variable, self-employed, and niche products. Include some that caused internal debate or investor pushback. - Step 2 – Run in parallel

Have your team run their normal income process while the vendor runs the same files through their engine. - Step 3 – Compare outputs

Look at:- Time to get a result.

- Differences in final income numbers.

- Conditions raised or missed.

- Clarity of reports for underwriters and QC.

- Step 4 – Involve underwriters and QC

Let them review results and provide feedback on trust, clarity, and usability. - Step 5 – Decide using data

Use a small set of metrics (time, touches, suspense, defects) to make a decision — not just slideware.

This approach gives you a realistic view of vendor performance without disrupting your pipeline.

10. How Rapidio answers these seven questions

Rapidio is built as a vertical income & Smart Conditions engine for mortgage lenders and brokers. Here’s how we line up against the checklist:

- Vertical focus: Mortgage income only — FHA, VA, Fannie, Freddie, reverse, DSCR, and more.

- Guideline logic: Dedicated guideline packs with configuration for your overlays and transparent updates.

- Transparency: Full income reports with step-by-step math, lookback windows, and rationale per source.

- Smart Conditions: Underwriter-style conditions for missing docs, gaps, declines, and inconsistencies.

- Human-in-the-loop QC: Structured review to ensure 100% checked, guideline-aware output.

- Integration: Flexible intake (portal/API) and LOS-friendly outputs, starting with fast pilots.

- ROI focus: We help you measure time per file, touches, and suspense to prove value quickly.

Choosing an income automation vendor is not just a tech decision. It’s a decision about how your entire organization will treat income, risk, and file quality for years to come. These seven questions are designed to make that decision clearer — and safer.

Take 20 recent loans — including your toughest income scenarios — and run them through Rapidio alongside your current process. Compare time, clarity, and conditions. Judge every vendor, including us, against the same seven questions.