What Docs to Upload for Accurate Income Calculation

Upload the right docs, get the right math. Use this checklist by income type to speed up reviews, cut conditions, and improve underwriting outcomes in Rapidio.

What Documents to Submit for Accurate Mortgage Income Calculation

The better the documentation, the faster and more accurate your results — and the fewer underwriting conditions later. Use the checklists below for each income type supported by Rapidio’s AI income analysis and document classification.

🏢 W-2 Wage Earner — Base Income

- Most recent 30 days of pay stubs (cover at least 30 days)

- Most recent W-2 (past year; two years if your guideline requires)

- Verification of Employment (written or third-party)

- Employment offer/contract with start date and rate (if new employment)

⏳ W-2 Wage Earner — Variable (Bonuses, Overtime, Commission)

- Two End-of-Year pay stubs + most recent YTD pay stub (with itemized OT/bonus/commission)

- Written VOE showing variable income breakdown (especially common for healthcare shift differentials)

- Employment contract or comp plan if applicable

- Any employer compensation statements

💼 Schedule C / 1099 (Sole Proprietors & Independent Contractors)

- Two years personal tax returns (1040) with complete Schedule C

- 1099s that align to the business activity (if applicable)

- Year-to-date P&L (often requested at underwriting stage)

- Optional but helpful: 2–3 months bank statements to evidence receipt trends

🏢 1120-S (S-Corporation)

- Two years personal returns (1040)

- Two years business returns (1120-S) with all K-1s

- YTD P&L (commonly requested at underwriting)

- W-2s or 1125-E for any owner wages/comp (if applicable)

🤝 1065 (Partnership)

- Two years personal returns (1040)

- Two years partnership returns (1065) with K-1s

- YTD P&L (commonly requested at underwriting)

- W-2s or 1125-E for partner comp (if applicable)

🏢 1120 (C-Corporation)

- Two years personal returns (1040)

- Two years corporate returns (1120)

- YTD P&L for the corporation (commonly requested at underwriting)

- W-2s or 1125-E for owner/exec comp (if applicable)

🏠 Rental Income (Schedule E)

- Two years tax returns with full Schedule E

- Current signed lease agreements for each property

- HOA/association statements or amortization schedules (if applicable)

- Optional but helpful: Rent ledger or proof of receipt

🎓 Retirement & Investment Income

SSA / Pension / Annuity

- Most recent award/benefit letter

- SSA-1099 or 1099-R (two years when available)

- Proof of receipt (e.g., bank statements)

Dividends, Interest, Capital Gains

- Two years 1040 with Schedule B (interest/dividends)

- Two years 1040 with Schedule D (capital gains)

🎖️ VA Disability Income

- VA Disability Award Letter or 1099

- Recent Certificate of Eligibility (COE) showing disability amount

- Helpful: Proof of receipt (bank statements)

📎 Optional: Alimony / Child Support

Borrower choice: Only provide this documentation if the borrower chooses to use it to qualify.

- Divorce decree or support agreement (signed)

- Proof of receipt per guideline (e.g., 6–12 months bank statements)

- Evidence of continuance per guideline

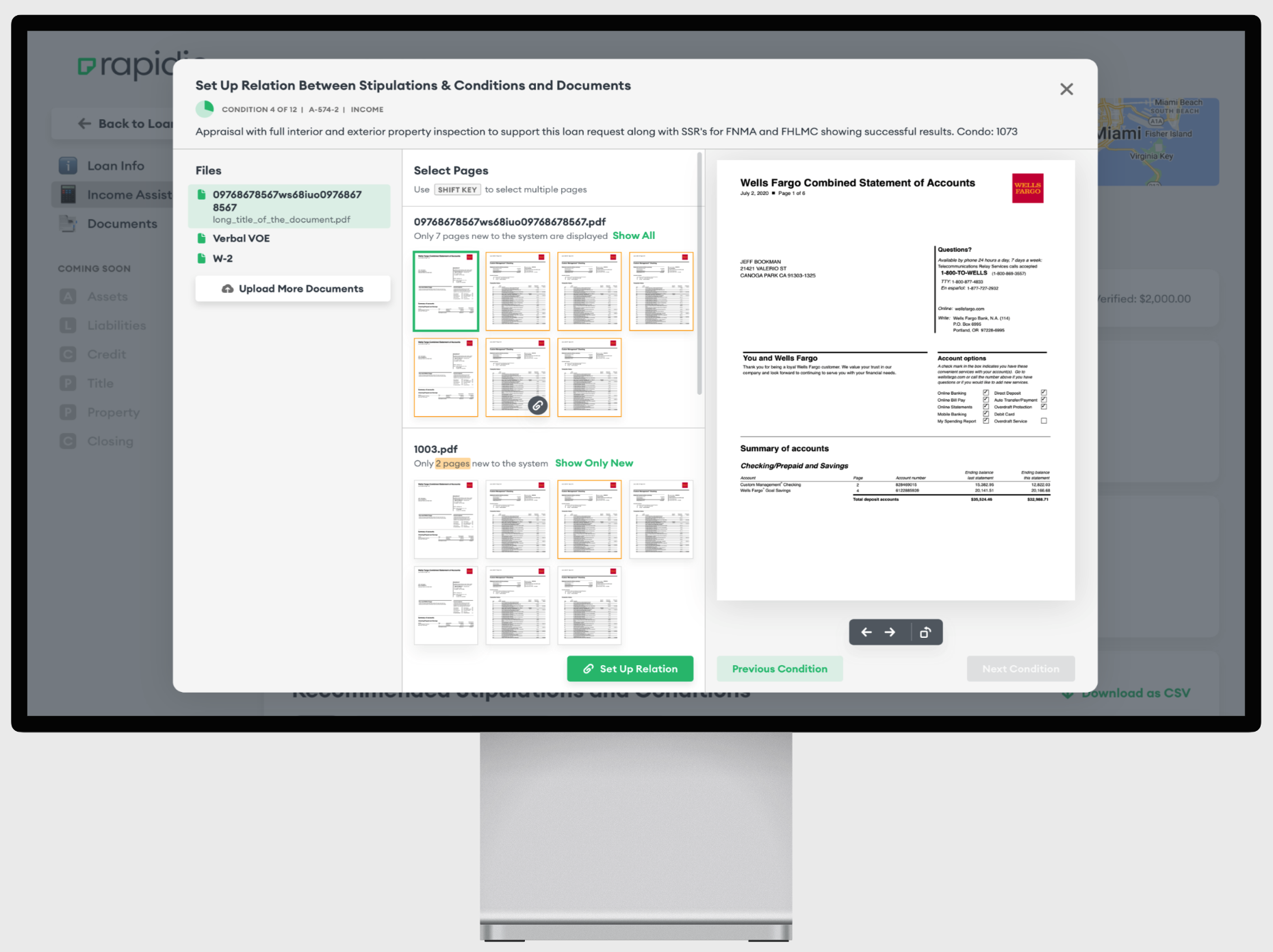

💡 Pro Tips & Upload Standards

- Combine by document type (e.g., all pay stubs in one PDF). Our Document AI will still classify correctly.

- Ensure legibility: avoid photos with glare; use scans or clean exports.

- Include prior years where program requires (e.g., variable/self-employed).

- Select the correct guideline (Fannie Mae, Freddie Mac, FHA, VA, or overlays) before submission so Rapidio applies the right math.

- Review Smart Conditions to clear easy items up front and avoid suspense.

FAQ: Getting Accurate Results

Do I need every item listed for each income type?

Follow your investor/program rules. The lists above reflect common requirements; Rapidio’s Smart Conditions will flag missing items specific to the selected guideline.

Are phone photos OK?

Yes if readable, but clean PDFs or scans perform best and minimize rework.

Can I upload mixed/unsorted PDFs?

Yes — our Document AI will classify and split. Combining by document type still helps speed review.

Does Rapidio replace DU®/LPA®?

No. Rapidio complements AUS by delivering cleaner inputs and guideline-aligned income math that improve findings quality and throughput.

What if I’m unsure which docs to use?

Ask our human QC team — every file is reviewed, and we’re happy to advise on edge cases.