AI Mortgage Income Calculation (Fast & Accurate) | Rapidio

Stop keying and start clearing. Rapidio’s AI + human QC delivers underwriter-ready income math and smart conditions in minutes — so your team moves faster with fewer surprises.

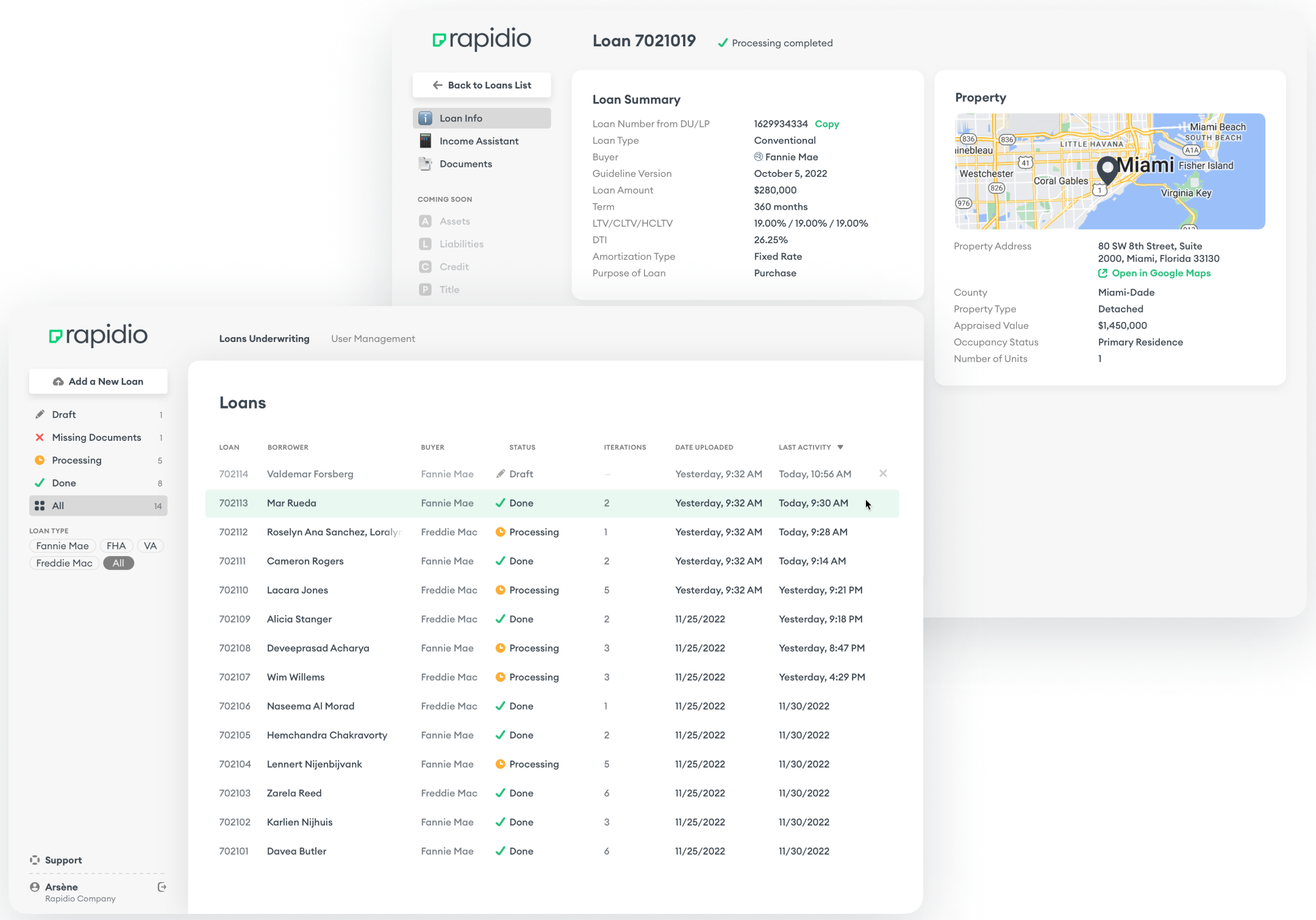

Rapidio: The Fastest, Most Accurate AI Mortgage Income Calculation Platform

If you’re a loan officer, processor, underwriter, or broker, you know income math is complex and error-prone. Rapidio automates the grind and standardizes calculations — reducing delays, conditions, and redraws.

Core Features

Document Classification

Reads and correctly names uploads (pay stubs, W-2s, 1040s, VOE, leases, bank statements).

Data Extraction

Pulls income fields from each document and normalizes them for consistent math.

Guideline-Aligned Math

Applies the right calculation by investor program and years of docs provided.

Smart Conditions

Flags missing items and likely UW asks so you can clear conditions proactively.

Underwriter-Ready Output

Delivers a transparent worksheet with assumptions and line-item provenance.

Turnaround

Average completion in ~17 minutes per fileAI + human QC

What Types of Income Does Rapidio Support?

- Wage earner income — including variable pay, bonuses, commissions, overtime

- Self-employed — sole proprietors, 1099 borrowers, Schedule C/K-1

- Business income

- Retirement income

- Rental income & lease agreements (Schedule E)

- Bank statement income analysis

No matter how complex the profile, Rapidio standardizes the math and provides a clear audit trail for UW and QC.

AI Document Classification for Mortgages

Our system automatically reads, identifies, and organizes uploads — from pay stubs and tax returns to VOE, leases, and bank statements — saving processors and underwriters hours per file and reducing errors. Pair classification with Automated Document AI and Income Analysis for best results.

Smart Conditions: Stay Ahead of Underwriting

- Identify missing documents early

- Surface potential UW flags before submission

- Clear conditions proactively and reduce time-to-close

Customizable to Your Business Needs

| Area | Options | Value |

|---|---|---|

| Guideline overlays | Configure internal rules & thresholds | Match investor/lender posture |

| Integrations | API, SFTP, LOS/POS/CRM connectivity | Fewer clicks; cleaner handoffs |

| Whitelabel | Custom branding and UX | Offer a seamless in-house experience |

Simple, Affordable Pricing

- $20 per wage-earner file

- $20 per self-employed file

- Discounted rates for members

- No limits on borrowers, income types, or number of documents per file

Fast Mortgage Income Calculation — with Human Accuracy

- Every file is reviewed by our human QC team

- QC staff available via email for questions

- Average turnaround ~17 minutes per file

Why it matters: AI speed plus human oversight reduces conditions and redraws—so you hit SLAs with confidence.

Who Uses Rapidio?

- Mortgage brokers & direct lenders

- Loan officers & processors

- Underwriters & QC departments