Underwriters • Loan Officers • Processors • Mortgage Brokers • CTOs

Revolutionizing Mortgage Lending with AI OCR Technology

Updated: · Rapidio

Author: Rapidio Editorial Team · Reviewed by: Senior Underwriter (10+ yrs) · About our review process

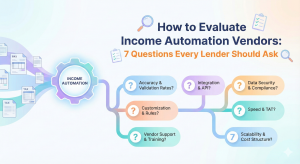

AI‑powered Optical Character Recognition (AI OCR) moves beyond basic text capture. In mortgage lending, it classifies documents, extracts key fields, validates relationships, and routes work asynchronously — fueling income calculation, verification, and AUS‑ready outputs for DU and LPA. The result: cleaner data, faster cycle times, and loan‑level cost control.

Structured, validated data

Shorter cycle time

Per‑file activation

Table of contents

Unveiling the Power of AI OCR in Mortgage Lending

Modern OCR systems do more than read characters — they detect patterns and layouts across paystubs, W‑2s, 1003s, tax returns, K‑1s, bank statements, and SSA‑1099 forms. This enables automated routing, exception spotting, and downstream calculations that once required manual review.

How Artificial Intelligence Enhances OCR

Machine‑learning models improve field recognition, table parsing, and context (e.g., distinguishing borrower vs. co‑borrower income or Schedule C vs. Schedule E). Synthetic training data helps cover rare layouts without exposing PII.

From OCR to Intelligent Document Processing (IDP)

IDP augments OCR with classification, key‑value and relationship extraction, validation rules, and workflow hooks. For lenders, that means searchable, structured data and consistent eligibility checks — ready for AUS or manual underwriting.

Security & Compliance

Enterprise deployments secure data in transit and at rest, enforce role‑based access, and maintain audit logs. Outputs align to guideline packs (Fannie Mae, Freddie Mac, FHA, VA) with clear provenance for exams and QC.

Handwriting & Multilingual Support

Advanced engines can read commonly used handwritten fields and support many languages. Capture quality, templates, and training still drive accuracy — set expectations and measure results by document type.

Adoption & Deployment

Cloud OCR/IDP services integrate via API and deploy quickly; on‑prem options exist for strict data residency. Start with high‑volume docs (paystubs, W‑2s, bank statements) and expand to tax returns, 1003s, and rental schedules.

How Rapidio Uses AI OCR

Rapidio includes document classification and data extraction at $0. Structured outputs flow into:

- Income Calculation & Eligibility — Fannie Mae, Freddie Mac, FHA, VA

- Automated Income Verification — transcripts & validations

- Bank Statement Cash‑Flow — borrower deposits & anomalies

Human‑in‑the‑loop QC from experienced underwriters provides confidence for edge cases and complex files.

Future Trends

Expect stronger table intelligence, better handwriting models, and tighter AUS/LOS/POS integrations. As models improve, more edge cases become automated — freeing experts to focus on judgment, not data entry.

FAQs

Can AI OCR really replace manual review?

Which documents see the biggest impact?

How do we measure success?

Will this work with our LOS/POS/CRM?

Start for free — 1 free calculation

Upload a file and get a decisionable income result in minutes. Choose Fannie Mae, FHA, VA, or Freddie Mac guideline packs.